Over $3bn paid or offered in compensation for financial advice related misconduct

Source Of News

February 14, 2022

Original article https://www.ifa.com.au/news/30763-over-3bn-paid-or-offered-in-compensation-for-financial-advice-related-misconduct (Neil Griffiths)

This is one of the main reasons Fourth Line was created – to help prevent such a thing from happening again. The value destroyed by the misconduct is not only the billions of dollars in compensation, but it’s also:

* the share price devastation investors have suffered associated with some institutions

* the mental anguish some clients have had to endure because of poor or inappropriate advice, or institutions not paying out on insurance policies etc

… and so much more.

Article content

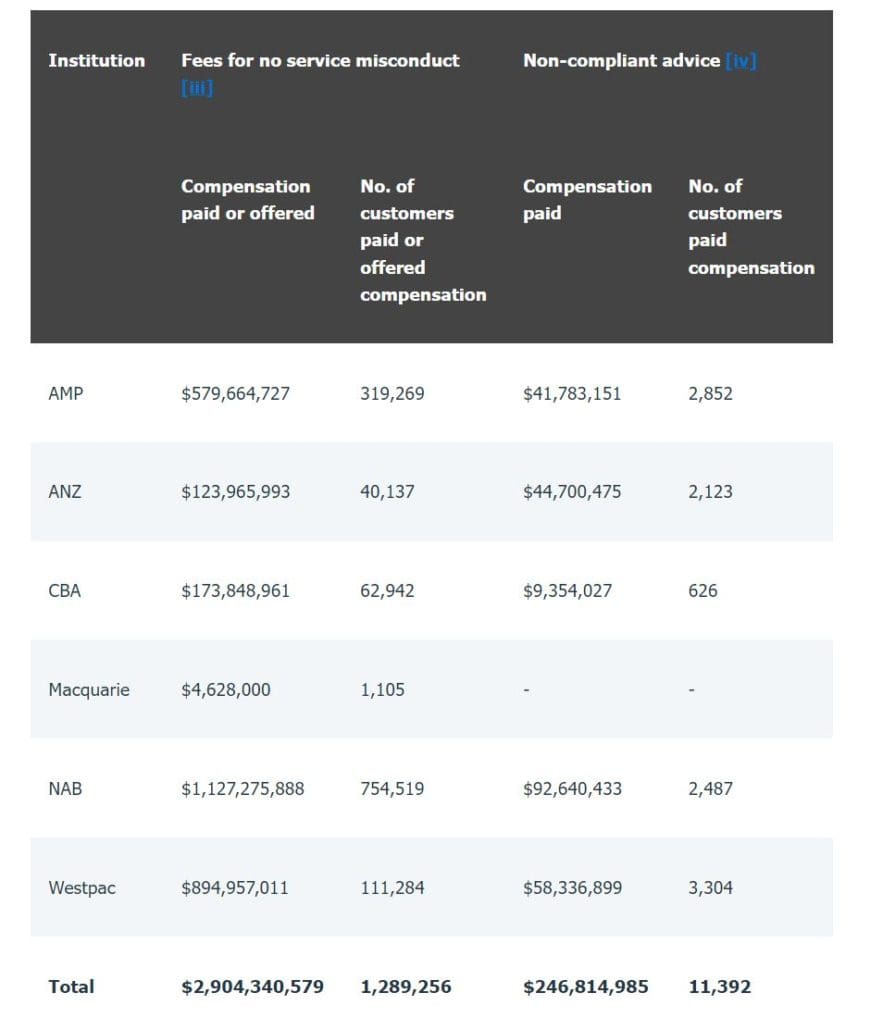

Six of Australia’s biggest banking and financial services institutions have paid or offered over $3 billion in compensation for financial advice related misconduct, ASIC has revealed.

The corporate regulator has confirmed that $3.15 billion as at 31 December 2021 has been paid or offered to customers of AMP, ANZ, CBA, Macquarie, NAB and Westpac who suffered loss or detriment because of “fees for no service misconduct or non-compliant advice”.

Almost $1.3 billion of that figure was paid or offered between 1 July to 31 December 2021.

NAB paid or offered the most compensation out of any of the institutions with $1,127,275,888, ahead of Westpac with the second most amount at $894,957,011.

Meanwhile the highest number of customers who were paid compensation came from AMP with the total figure being 2,852.

The six institutions undertook the ASIC review which looked into the extent of failure to deliver ongoing advice services to customers who were paying feeds to receive those services and how effectively the institutions supervised their advisers to identify and deal with “non compliant-advice”.

See the full breakdown below.

———————————————————————————————————————————————————————————————-

For information email: info@fourth-line.com.au

Fourth Line is a rigorous RegTech risk management and compliance system for advice practices, dealer groups and other wealth management participants. Fourth Line uses algorithmic approaches to simplify the complexity in advice reviews whilst maintaining human oversight, empowering compliance teams to coach and develop strong advice behaviors through data driven insights from advanced analytics for adviser, practice/dealer group and industry benchmark comparison with centralised document storage and access to meet regulatory needs.