The Personal Advice Equation (Memory Hack)

Source Of News

By Joel Ronchi, COO, 15th August 2022

Back when I was known as the “FASEA Guy”, a simple memory hack I came up with for advisers who needed to sit the (FASEA) Adviser Exam was as follows:

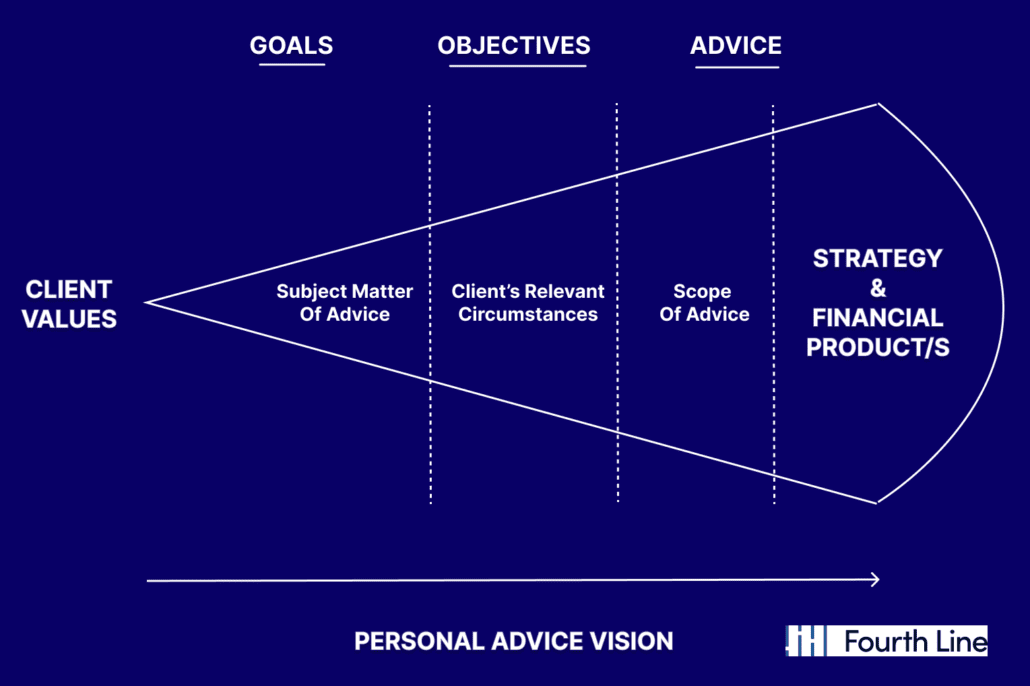

SMA + CRC = A (S + P)

- SMA = Subject matter of the advice sought by the client (implicit and explicit)

- CRC = Client’s relevant circumstances (including objectives, needs, and financial situation

- A (S + P) = Advice provided by the adviser, including both strategy and product (if relevant)

The idea was simple – for exam scenarios involving the provision of advice by an adviser, use this equation to identify what “appropriate advice that was in the best interests of the client” looked like, and then contrast this against the given scenario to identify any gaps, from which the exam candidate could then formulate an answer.

In my time with Fourth Line, it has become apparent that some advisers in the real world are struggling to with this equation.

The struggle is not based on deliberate, deceptive, malicious intent; rather it is a lack of understanding of the meaning of each part of the equation and how the separate “variables” interact and are inter-related.

Fourth Line has reviewed almost 9,000 SOAs over the past 3 years. The Fourth Line review considers more than just the SOA created by the adviser, as we understand the SOA is simply the output of the personal advice process followed by the adviser.

The Fourth Line “advice analysis engine” considers, in great depth, the “advice process” followed by the adviser. Fourth Line achieves this by interrogating the supporting documents which underpin the advice process such as the fact find, risk profiling notes, files notes, and any other relevant documentation.

Why do I mention this?

Because it is apparent from the thousands of SOA reviews, and the process underpinning the creation of each SOA, that there still exists systemic industry level misunderstanding of the key components that make up the “safe harbour” and “appropriate advice” provisions.

In particular, areas we continue to see struggle with are:

- Appropriate scoping of advice

- Clearly identifying client objectives and needs, and being able to prioritise these

- Undertaking reasonable investigations into a client’s current financial situation

- Explaining why the recommended advice was more appropriate than alternatives considered

- Lack of considering genuine, realistic and appropriate strategies and/or financial products

This is not an exhaustive list.

In speaking with our clients, and potential clients, it seems much of the challenges may stem from an inconsistency in the definition of key terms across industry stakeholders and individual advisers.

For example ..

- What is a goal?

- How does a goal differ to a need?

- Is a goal the same as an objective, and if not, how do they differ?

- When considering the subject matter of advice, what is implicitly versus explicitly?

Why is this important?

Because when you look at s961b(2) and the safe harbour provisions, you will note there is no mention of “goals” in the legislation.

In fact, the word “goals” only appears once (outside of example scenarios) in the June 2021 updated RG175, and is not defined in the “Key Terms”.

The definition of “personal advice” in the Corps Act only refers to a “… client’s objectives, financial situation and needs;”

ASIC brings the concept of goals in to play in RG 175.248 discussing the adviser helping the client “… to set prioritised, specific and measurable goals and objectives;”.

“Objectives” ae also undefined in the Corps Act and RG175.

So it is left to individuals in the industry to define what these mean in the context of providing personal advice. This has traditionally led to a lack of consistency in the application of the law by compliance teams across the various licensees.

It’s time to reimagine compliance by better understanding what is required.

See LinkedIn posts: https://lnkd.in/g-SkV499 & https://lnkd.in/gw8zBR_X

————————————————————————————————————————————————————————————————————————————

Fourth Line is a rigorous RegTech risk management and compliance system for advice practices, dealer groups and other wealth management participants. Fourth Line uses algorithmic approaches to simplify the complexity in advice reviews whilst maintaining human oversight, empowering compliance teams to coach and develop strong advice behaviors through data driven insights from advanced analytics for adviser, practice/dealer group and industry benchmark comparison with centralised document storage and access to meet regulatory needs.

For information email: info@fourth-line.com.au